The Ultimate Guide To Pvm Accounting

Building Accountancy and Financial Monitoring is a program provided by the University of California, Davis. It features trainer Joann Hillenbrand, CCIFP who currently acts as the Chief Financial Officer for Airco Mechanical, Incorporated. Joann has even more than three decades of experience in construction accountancy and teaches students a range of abilities, including: contract management audit cash money monitoring monetary declaration management building accounting fundamentals building risk administration fundamentals (consisting of insurance coverage) The program sets you back $865 to take part in.

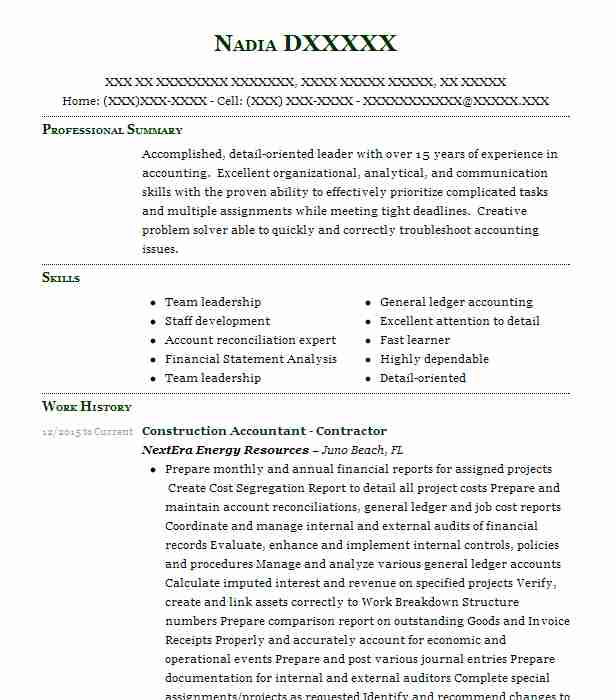

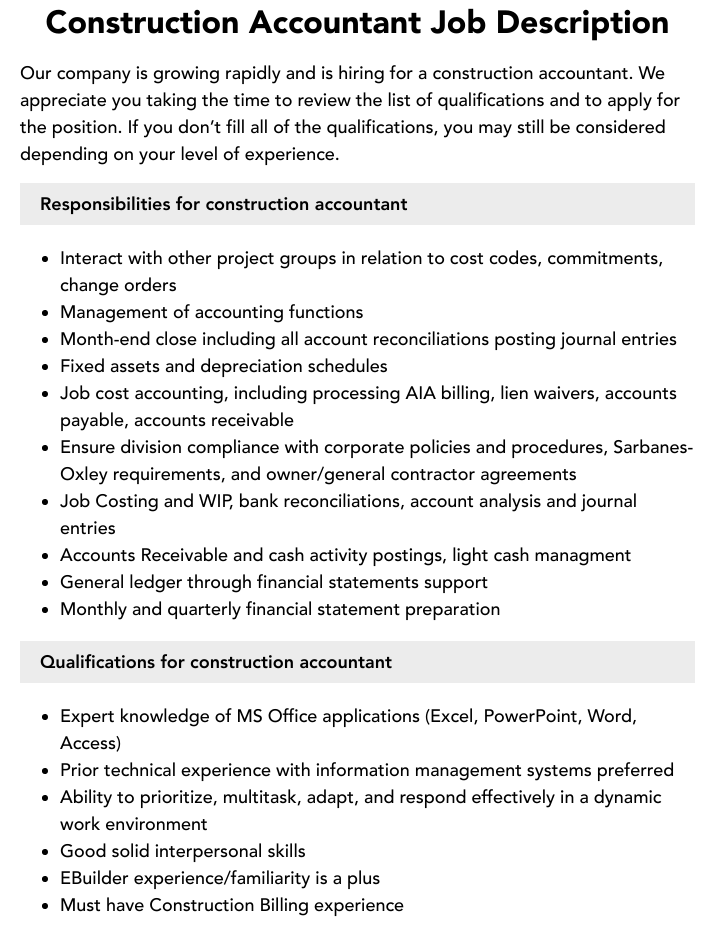

Instead, business typically need levels and experience (i.e. permanent work or internships). Building and construction accountants manage financials on tasks and for their business on the whole. Tasks consist of: planning/coordinating task financials looking after numerous sorts of monetary analysis (i.e. task cost quotes) assessing economic documents (i.e. billings, agreements, and so on) tracking expenditures and revenue examining (and identifying methods to address) financial threats, both on specific jobs and those influencing the company as a whole preparing and submitting financial records, both to stakeholders and pertinent governing bodies To come to be a construction accounting professional, an individual need to typically have a bachelor's degree in an accounting-related field.

An Unbiased View of Pvm Accounting

Learn a lot more regarding Bridgit Bench, a workforce preparation application developed to assist building and construction specialists (consisting of building accounting professionals) take care of numerous facets of their work a lot more successfully. Michel Richer is the Manager of Content and Item Advertising at Bridgit. He began in the construction market early on with a local remediation firm.

A construction accountant prepares monetary statements, monitors prices and budgets, and collaborates with task supervisors and associates to make certain that the business financial demands are met. A construction accounting professional functions as part of the audit department, which is in charge of generating monetary reports and analyses. Building and construction accountants might also aid with pay-roll, which is a kind of accountancy.

Little Known Questions About Pvm Accounting.

Proactively dealing with expense and functional related matters with job supervisors, property supervisors, and various other interior job stakeholders every day. Partnering with interior job monitoring groups to ensure the financial success of the company's development projects using the Yardi Job Cost module, including establishing tasks (work), budgets, contracts, change orders, order, and handling invoices.

Capability to prepare records and business correspondence. Capacity to efficiently present info and reply to questions from groups of managers and straight and/or professional employees. Digital Realty brings companies and data together by delivering the full spectrum of information facility, colocation and interconnection solutions. PlatformDIGITAL, the business's worldwide data facility system, offers clients with a Visit Website secure data conference area and a tried and tested Pervasive Datacenter Architecture (PDx) solution approach for powering innovation and efficiently handling Data Gravity obstacles.

Some Known Facts About Pvm Accounting.

In the very early phases of a building and construction business, business owner likely manages the building and construction accountancy. They handle their own books, care for accounts receivable (A/R) and payable (A/P), and supervise payroll. As a building and construction business and list of jobs grows, nevertheless, making economic choices will reach beyond the duty of a bachelor.

For several months, and even a pair of years, Bob performs all of the important accountancy jobs, numerous from the cab of his truck. https://www.intensedebate.com/profiles/leonelcenteno. He manages the capital, gets brand-new credit lines, chases down unpaid invoices, and puts it all into a single Excel spreadsheet - construction accounting. As time goes on, they realize that they barely have time to take on brand-new tasks

Quickly, Sally ends up being the full time bookkeeper. When accounts receivable hits six figures, Sally realizes she can't keep up. Stephanie joins the bookkeeping team as the controller, making sure they have the ability to stay on par with the building projects in 6 different states Determining when your building and construction company awaits each role isn't cut-and-dry.

Pvm Accounting Can Be Fun For Everyone

You'll require to figure out which function(s) your company needs, relying on monetary requirements and firm breadth. Right here's a malfunction of the common duties for every role in a building and construction company, and just how they can improve your repayment procedure. Workplace supervisors put on A LOT of hats, particularly in a tiny or mid-sized building and construction business.

$1m $5m in yearly earnings A controller is typically accountable of the accounting department. (You'll likewise see this setting led to "comptroller.") A controller might establish up the audit department. In a little business they may be doing the bookkeeping themselves. In bigger companies, controllers are most likely to oversee accounting personnel.

The building and construction controller supervises of producing exact job-cost audit records, joining audits and preparing reports for regulators. Furthermore, the controller is accountable for guaranteeing your company abide by monetary reporting policies and regulations. They're also needed for budgeting and surveillance yearly performance in regard to the yearly budget.

Pvm Accounting for Dummies

Comments on “Top Guidelines Of Pvm Accounting”